What is in Store for GenX over the next 10-20 years?

We talk a *lot* about the coming retirement crisis for Boomers, but not so much about the group right behind them.

GenX is in between everything.

We’re called the “sandwich generation” for a reason.

On the one side there are the stressed, sullen Millenials, and the even more anxious and infuriated GenZ, either resigned to their apparent fate that a realistic chance of home ownership or upward mobility, or being economically secure enough to start a family, has been denied them.

On the other, there’s the Boomers, who, on one hand have some serious challenges ahead of them economically - for example, half of all Boomers in the US have no retirement savings at all, and of those who do - half have less than 25K saved (IIRC the average savings for Baby Boomers currently is around 100K).

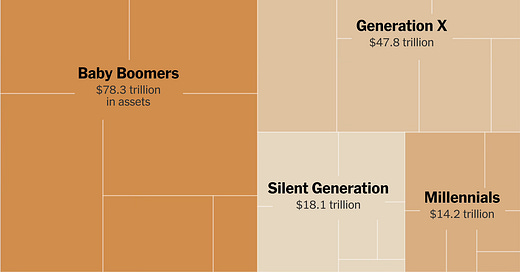

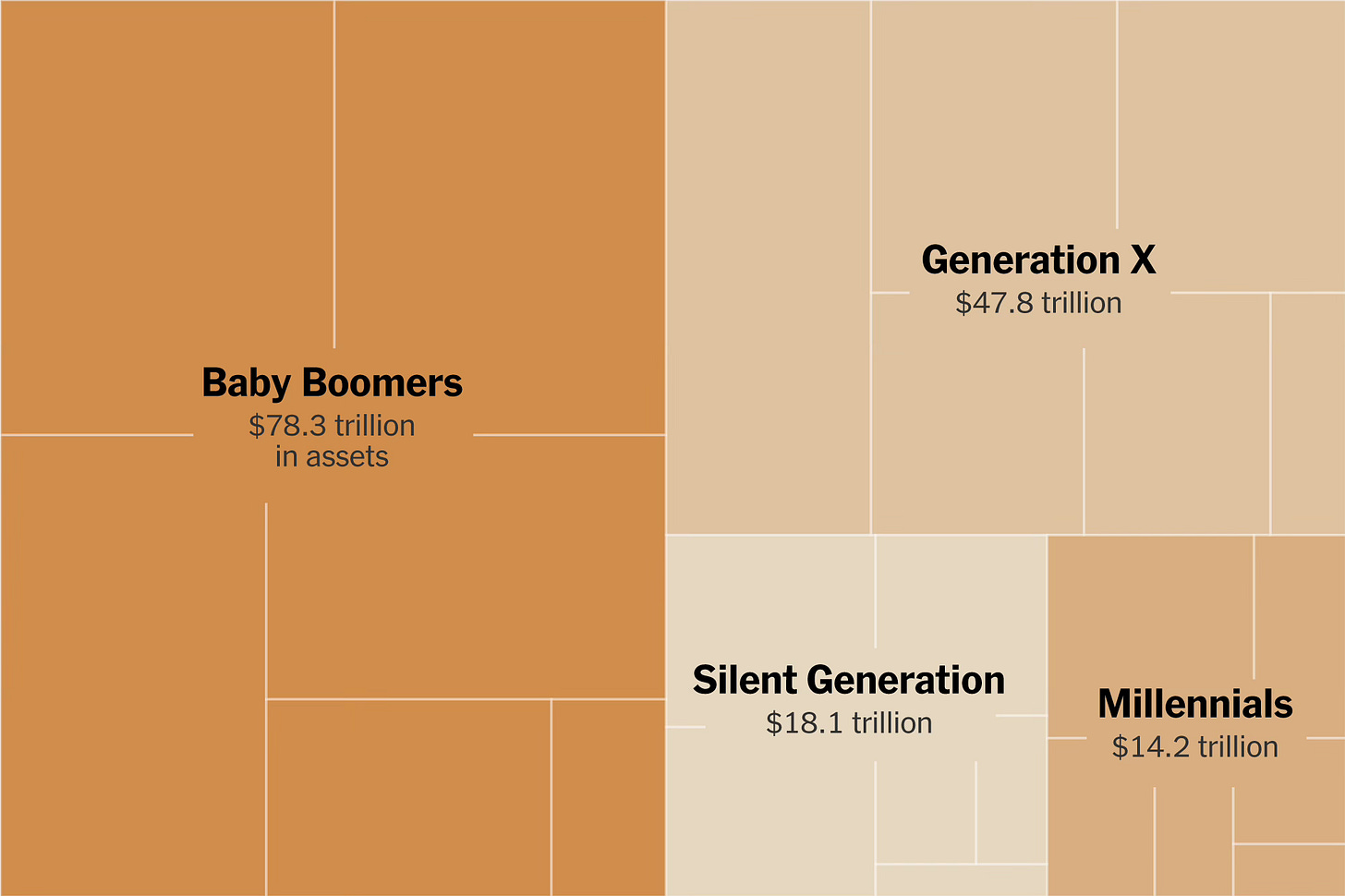

As Millenials and particularly GenZ seem very aware, the sheer amount of saved wealth amongst the remaining Boomers is enormous - they are the richest group - at least in the aggregate. This makes the Boomers both a target of generational angst and anger, as well as a looming - and growing - economic victim1.

While the relatively small percentage of wealthy Baby Boomers drive up the statistics for amassed wealth across generations (which GenZ & Millenials are more than aware of) - clearly what is going on with Boomers is also a microcosm of American society. There is a large wealth gap.

But what of GenX?

Superficially, you’d think that GenX might in some ways be doing a bit better than Boomers (aggregate statistics on assets aside). We are at the prime of our earning potential, largely still able to work, and. moreover, we have a bit of foresight into the mistakes of our elders, the Boomers - for example, I’ve talked at length about the folly of ending up in your golden years about being reliant on a fixed income in retirement, basically because I’m convinced the next 10-20 years will be structurally inflationary. Moreover, GenX is the first generation that was forced to rely on 401Ks for retirement savings - unlike our Boomer parents, we don’t get pensions.

I actually didn’t know the statistics on wealth dispersion amongst GenX - but apparently, interestingly, the statistics amongst our group is even worse than that of Boomers. In other words, the “wealth gap” is even more pronounced amongst GenX.

This is what Perplexity.AI told me:

“A study from the National Institute on Retirement Security (NIRS) found that the typical Gen X household has only $40,000 in retirement savings, while the average savings amount is $153,300, according to Fidelity Investments. This discrepancy between the typical and average savings amounts suggests that a few wealthier individuals skew the average upwards, leaving a large portion of the generation with significantly less. The top 25% of Gen X earners have, on average, $250,000 in retirement savings, whereas the bottom quartile has around $35,000, and the median for the bottom quartile is as low as $200, indicating almost no savings. This data underscores the severe wealth concentration at the top and suggests that the wealth dispersion within Generation X is indeed poor, with a majority not financially prepared for retirement.”

GenX will have a Front Row Seat to Mass Social Unrest Driven by Economic Angst, Popping of Debt Bubbles, and Geopolitics

So if you believe demographers and social commentators like Neil Howe of the “Fourth Turning” fame, and Peter Turchin, we are in for some significant social upheaval (which, in case you haven’t been watching US college campuses, already seems to be well underway).

For GenX - this means that during our prime earning years, but also when we are under maximum pressure caring for our children, but also often caring for our aging parents, we will get to have a front row seat for societal collapse.

Oh, joy!

This is being fed by major anger from Millennials and GenZ who, as far as they can see, simply just can’t catch a break economically.

They are also more or less ‘digital natives’ and spend enormous amounts of time online, and seem to be increasingly radicalized by the content they see and hear online from the overwhelmingly left-wing legacy media, and otherwise curated by large, unaccountable, Orwellian speech-regulators and narrative-managing NGOs and government bureaucracies like the Stanford Internet Observatory, Graphika, and the Department of Homeland Security’s CISA. All of whom are helped by sprawling, extreme-leftist technology companies like Google, Facebook, and TikTok.

Just the way I see it.

Meanwhile, the Boomers, particularly the wealthy and well-connected ones - continue to desperately hang onto their wealth and power, and further wall themselves away in planned communities, retire from their jobs en masse with bloated 401K and stock balances, and leave the remains of their businesses and jobsites for the rest of us to manage.

Which brings us to….

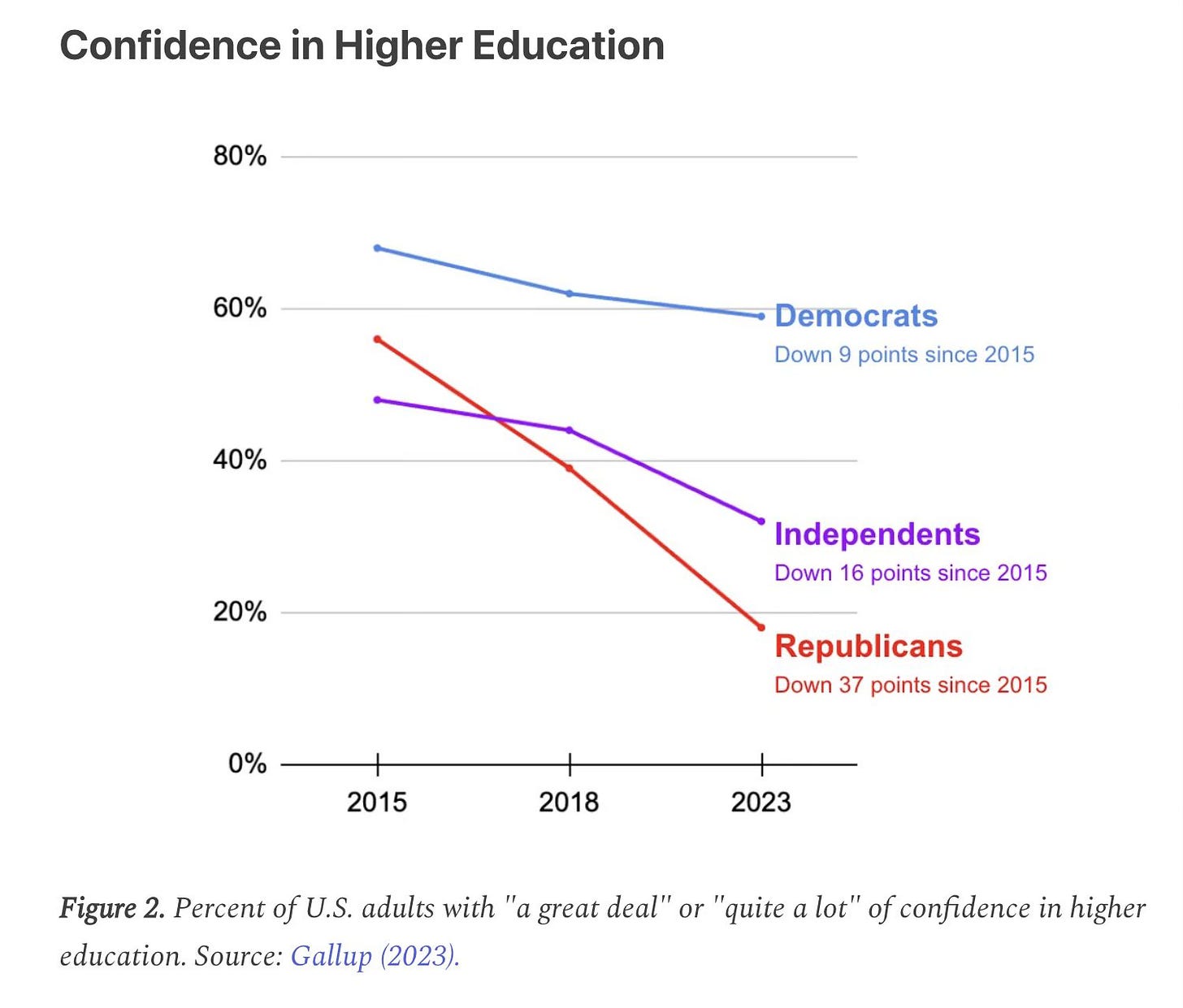

Institutions Will Continue to Decompose

I tried finding a similar graph about “trust in medicine” or “trust in medical institutions” and I couldn’t find a good one - but the results are in line with the graphs above.

So, what GenX gets to have a front-row seat for is the major collapse of trust for all major civic institutions; government, media, healthcare, and higher education.

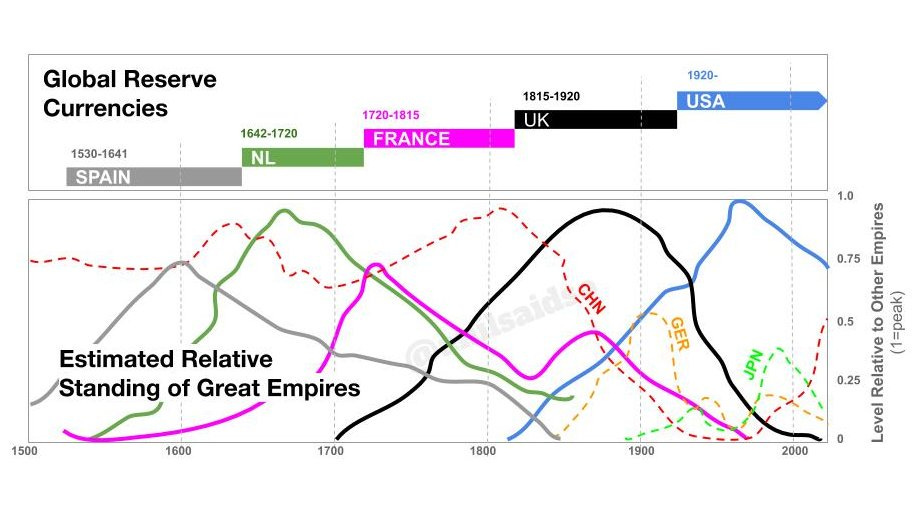

GenX will likely see a “Currency Reset” in their Lifetimes

Although it sounds like a conspiracy theory, it truth, “resets” such as this, like when the British pound sterling went from the world reserve currency standard to what it is today - barely a blip in terms of bond market - are surprisingly regular when viewed across the sweep of history. It’s not something to bemoan or struggle against, honestly - it’s just something to plan for.

For the United States, yes, we won World War II and then later, saw the falling of the Berlin Wall and the “Pax Americana,” and this led to globalization, offshoring, and the “just in time” economy - and brought us 40+ years of disinflation and steadily falling interest rates.

However, we need to realize that this was a unique period of history, and one which will, in my opinion, never be returning.

The implications of this are significant when viewed across the next 10-20 years, and profound over the next 40+. What are they?

First, while the US and western world has seen some success boasted of by central banks in terms of “winning the inflation fight,” we need to recognize that for the forseeable future, inflation isn’t just a cyclical issue - it is structural. The much ballyhooed Federal Reserve’s 2% inflation target (which apparently was basically made up by New Zealand central bankers in 1989 and then adopted by the US Fed because it sounded scientific) is basically dead on arrival.

Inflation, the slow-but-steady erosion of the purchasing power of your currency over time, is embedded in the system.

The reasons for this are multifactorial.

Also, if anyone noticed - the “globalization” trend - typified by the expectation from the United States that we can just snap our fingers and expect China or India to cheaply provide us with goods that we are unwilling to produce domestically - is over. “Onshoring” or “friendshoring” is now the trend, which means things will be more expensive.

Second - there’s this:

Most economists agree that once a country exceeds a ratio of around 100% of their sovereign federal debt when measured against their gross domestic product (GDP), the typical options of controlling out-of-control government finances, like raising taxes or lowering spending (austerity) become practically impossible.

Therefore, the only option left is default - and no, I don’t mean formal default where the US government calls creditors and renegotiates terms, or says “sorry, we won’t pay you” - because that’s not going to happen.

The US government *will* repay its debts. But it will do so by devaluing it’s currency. This is what every government will do, and has to do. There are various mechanisms by which they do this, such as “yield curve control.” and use of “capital controls” and “financial repression,” but just recognize that this is simply the way it’s going to be.

So what does a GenX Person Do? First, Save Properly

If you’re in your 50s, like me - probably a few things. For your investment portfolio (if you have one) - plan for uncertainty. When you think of an investment portfolio with uncertainty hedges, what do you think of? Lots of tech stocks, “growth” stocks, or even “safe government bonds”? Yeah, no.

The idea is to focus on investments in “things you can drop on your foot” - things with a physical presence, like commodities such as grain, orange juice, or barrels of oil, or precious metals like gold, and silver. The context for this idea is that these tangible assets can have intrinsic value and utility, as opposed to more abstract financial instruments - which, when trust in society is collapsing around you, might not be the best thing to bet on.

I also like Bitcoin - what a lot of people call “digital gold” (and in fact, it was designed with the properties of gold in mind). While there are a lot of people that poo-poo it, still, as a scam and that it will eventually be made illegal or whatnot - I personally think it’s worth having some.

Just in case it catches on.

Invest Heavily in Your Health

The fact is, despite what you’ve been told, no one can be trusted with your health more than you. Remember what I said earlier in this article about how institutional trust is collapsing? Yeah - this includes medicine.

One of the things that’s been personally helpful for me about working in the long-term care industry as long as I have is seeing the terminal state of older people as their habits have caught up with them. Avoiding exercise. Bad nutritition and overeating. Alcohol. Tobacco. Drugs. And so on.

Obesity and impaired mobility, hypertension, sleep apnea, dementia, amputations, I’ve seen it all. It’s no way to live out your later years, it’s expensive to take care of a person who is in this kind of state of wreckage, and honestly, we all have to come to terms with the fact that collectively, there’s very little political, collective will and basically zero balance sheet capacity to effectively and compassionately take care of older people who are in such a state. Best thing to do is avoid getting there, and start taking care of yourself now.

Consider a “Plan B”

This is a bit more of an extreme solution, but one I respect for the people that have done it. Look into other countries that maybe don’t have the collapsing-empire dynamics the USA seems to be exhibiting. If you are getting older, and may anticipate a need for long term care or facility-based care, there are plenty of countries (I’ve heard Thailand is great) where you can get excellent care for a relative pittance compared to the USA.

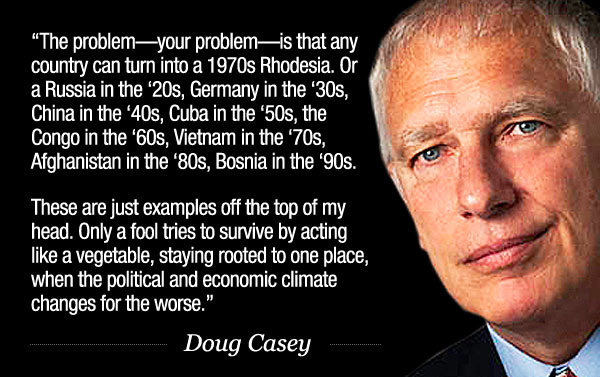

The “International Man” himself, Doug Casey (look him up on YouTube - worth it!) has made a pretty entertaining case for this, as has another fave of mine, Mark Moss talks about this from time to time, the idea of having a backup plan, with passports, and ideally second homes and living situations set up in case, well, basically the USA goes full Venezuela, complete with hyperinflation, a full-on police state, and general social breakdown.

I do not have one yet, but I consider more and more the wisdom of this idea. Sure - the United States is in a relatively good place, I guess, compared to other countries? But the bigger they are, the harder they fall, right?

Conclusion

It looks to me like GenXers are in for quite the rollercoaster ride over the next couple of decades.

Sandwiched between the economically beleaguered Boomers and the disillusioned, economically strapped Millennials and Gen Z, we're smack in the middle of what could only be described as a generational tug-of-war. This is, of course, leaving aside the whole societal-collapse-bingo-game we all seem to be playing - and that we as GenX apparently will get gifted front-row-seats.

Boomers, of course, are facing their own financial Armageddon, with half of them, staggeringly not having a penny saved for retirement. Meanwhile, the younger generations are stewing in their own pot of economic despair, fully aware that the wealth pie has been unevenly sliced, with Boomers holding the larger piece.

But here's the kicker: when you actually dive into the numbers, GenX's financial picture isn't just bleak; it's like a bad joke without a punchline. Our wealth gap is even more pronounced than the Boomers', with a retirement savings scene that's more desert than oasis.

If watching our financial stability turn into a mirage wasn't entertaining enough, we're also the lucky audience to a potential global economic upheaval. Think mass social unrest, the popping of debt bubbles, and ongoing, exhausting, and potentially dangerous geopolitical shenanigans that will potentially make the Cold War look like a time of serenity and ease. Oh, and obviously we should not also forget the currency reset that’s due to profoundly shake up all of our savings plans.

But here's where it gets good.

Despite this doom and gloom, us GenXers have something going for us. We've weathered the storms of recessions, market crashes, the threat of everpresent nuclear anhillation as children - heck, we're the "latchkey generation" that learned to fend for ourselves when the world wasn't looking.

This is what sets us apart. As we stare down the barrel of the next 10-20 years, let's not forget who we are.

We might not have the economic advantages of the Boomers or the native digital savvy of the Millennials and Gen Z, but we've got a knack for intellectual and emotional independence and for making the best out of a bad situation, and keeping a sardonic sense of humor about the whole thing.

Because, let's face it, if anyone's going to navigate this mess with a bit of style and a smirk, it's going to be GenX.

Saw this video earlier today, in fact - Youtuber Mark Moss is great and gives a nice overview of the economic issues facing boomers:

Me, as a 9-year-old in 1975 at the department store in Denver:

Me: "Mom, I'm bored!"

My mother: "Then go wait in the car. It's unlocked"

Thank you Doc for reminding me that we X-ers can and will survive anything that comes our way the next 20 years, with our trademark humor and style.

With Biden in Charge, may be nothing next for us all.