Social Security: Gone Well Before 2040

This will be how we solve the USA's debt-deficit spiral pathway we are on. By "stealing from old people slowly" - or worse.

Ponder This

The United States is in a debt spiral in terms of government finances.

The government can’t formally default (e.g., walk away from it’s debt) - it’s like a geopolitical equivalent of five million nuclear bombs. Won’t happen.

We’re too far gone for austerity, that is to say, tax increases and spending cuts - to work. It’s just politically and mathematically impossible at this point.

Barring some magical “productivity miracle” (like the US invents cold fusion and rapidly deploys it), we can’t grow our way out of it either.

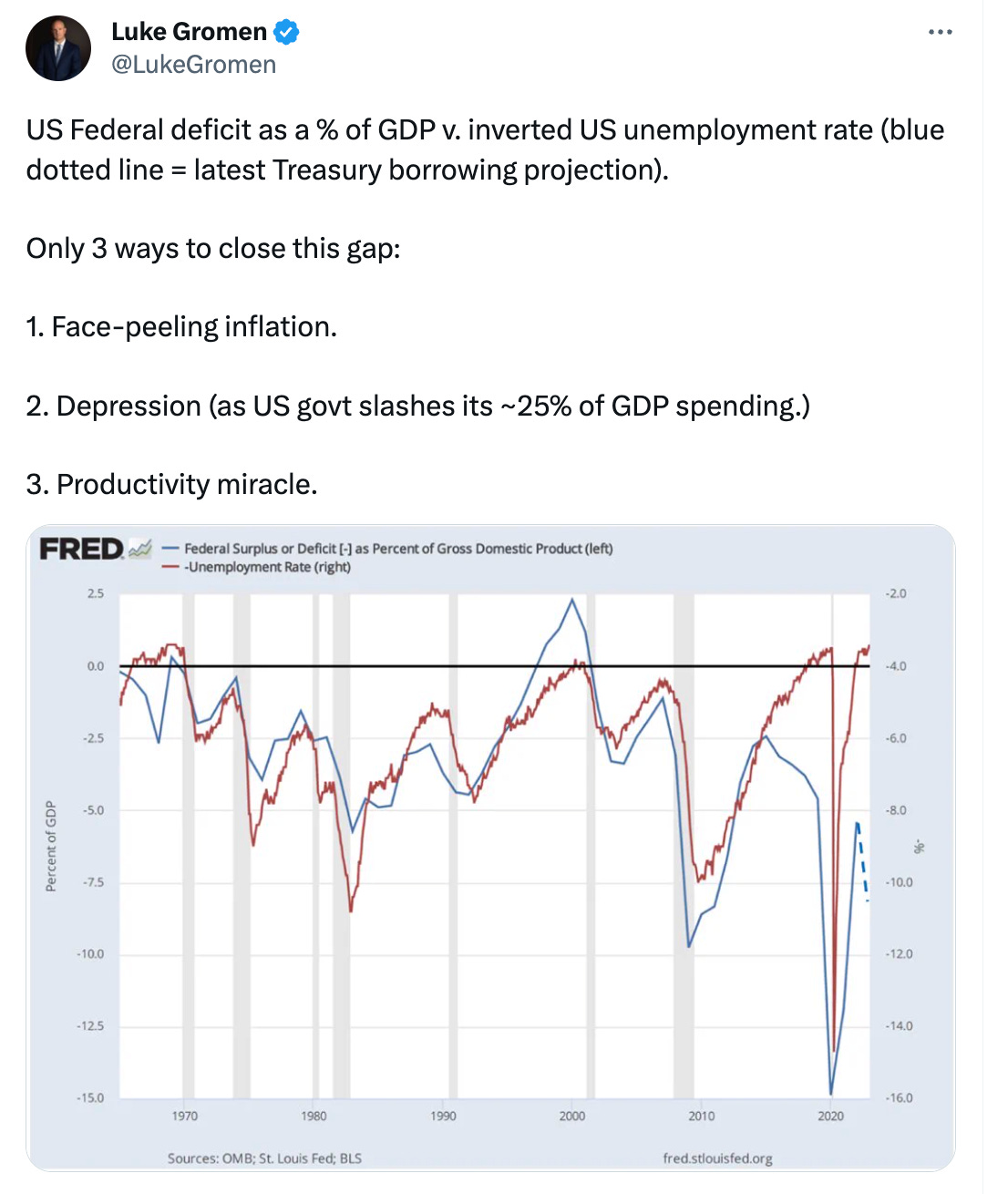

The only way left is a “soft default” through devaluation of the dollar - via inflation. My favorite macro finance guy, Luke Gromen (love his videos) put it best:

“But Inflation is Coming Down! Fed Defeated Inflation!”

Been hearing this in the news and on Twitter / X lately. A few months ago everyone was predicting a recession. Now there’s no recession - not even a “soft landing,” but no landing."

I’m not going to go through the details, but basically, the idea that a recession delayed (very likely through aggressive use of the Fed’s Bank Term Funding Program - or BTFP) equates to a recession avoided seems a bit premature to me.

What I think is going on:

Right now inflation is coming down (disinflation) - which I think will likely turn into outright deflation in a number of areas (excepting energy) in the coming months.

Then what we’ll get is a recession - and possibly a bad one, fully recognized by 2024. That’s going to make the US federal deficit - currently at 2 trillion dollars over the last 12 months, even worse.

As tax receipts continue to drop and the deficit continues to blow out, earlier debt will continue to reprice, as I mentioned above, which will just make debt service payments increase, and will just blow out the deficit further. This will cause yields on debt to spike as well (e.g., the phenomenon of the bond market demanding higher yields to compensate for the increasing risk of holding US debt). This will get us into an even deeper hole.

How does this get solved? My answer - pick on the most vulnerable. Seniors.

“Stealing from Old People Slowly” - Or Worse

“Financial repression means stealing money from savers and old people slowly. The slow part is important in order for the pain not to become too apparent. " - Russell Napier

I wrote this article awhile back and it got a surprising number of hits (odd, because I feel like most of you visit this Substack to hear me rail about force masking old people and their professional caregivers).

In the coming years, as the retirement tsunami of Baby Boomers fully takes hold, you’ll have armies of old people dependent on Social Security as their primary or exclusive source of income.

This is a huge problem. For starters, the average social security monthly income check is about 1.7K per month, or about 20K per year. In many parts of the United States, this is far, far beyond what social security income can support (in the Bay Area, California, for a household to be considered “middle income,” approximately 350K per year of income is the minimum).

To get to a part of the country where an average social security income could even approach meeting the bare minimum cost of living, you’d have to settle in exotic Akron Ohio, according to GoBankingRates.com:

Even then - this barely covers it, and this is with no savings left over.

Anyone around 50 years old or older probably needs to do two things when they do retirement planning (that is to say, calculating how much income they may expect from retirement when they, either by choice or circumstance, stop working). They need to do essentially two calculations:

ONE - calculate retirement planning with Social Security, the USA’s flagship public “social insurance” program for older adults.

TWO - do a second calculation without it.

If you’re on the younger side of GenX, or are a millennial (born in the early 1980s to 2000s), I would argue you might want to plan on it not existing at all – or being so inconsequential that you shouldn’t even factor it in.

The legendary investor Stanley Druckenmiller (with a net worth of around 6.4 billion) recently did a keynote address at the USC Marshall Center for Investment Studies on May 1st, 2023, and said a lot of things that policymakers, the financial products industry, and in general, the American public have steadfastly ignored for the past 40 years as the nonstop bull market US government bonds and credit has allowed us to all collectively ignore basic math.

“The Druck” reminded us that the US government is, for all intents and purposes - broke – and spelled out in specific terms what that means for so-called US entitlement spending (e.g., specifically Social Security, Medicare and Medicaid) in the coming years.

The numbers – the raw math, really, paints a very sobering if not basically alarming picture. With no changes made to the promised outlays of these three programs, in order to support the current level of spending on our safety net programs into the future, US taxpayers would need to overall shell out an overall tax increase of about 40% just to keep spending at roughly their current level for retirees and disabled people.

Or, alternatively, in order for these programs to retain some sort of sustainability – these programs would need to be cut by about 35% across the board.

Without any changes – and this is where it gets grim – by approximately 2040, about 100% of our current tax revenues would be required, just to fund entitlements (along with debt service payments) alone. Mind you - this is assuming no recession or depression takes place between now and then.

Let me be clear - gone are the days that “deficits don’t matter,” particularly when we keep in mind the issue that somewhere around 1.5 trillion dollars of federal debt will reprice within the next 12 months, with at least 10 trillion repricing within the next decade (and the current US federal funds rate – the benchmark interest rate, is just above 5.25%).

The US federal deficit in 2024 (not the debt – but simply the gap between revenues and spending) will be likely at least 1.4 trillion dollars. This is a long-winded way of saying something that everyone in at least 10 years of retirement (or perhaps even less) really needs to look long and hard at their retirement planning.

Depending on who you ask, somewhere around half of the current crop of Baby Boomers (e.g., those born between 1946 and 1964) have zero retirement savings at all - and according to figures by the famously debt-averse financial planning guru Dave Ramsay, of those who save, about half have less than 25K saved at all.

This is Where it Gets Scary

I think that what’s going to happen over the next few years is that either formally or stealthily (through inflation, as I mentioned) - Social Security and Medicare benefits will be cut. Old people will be the hardest hit.

I think there is, in a way, a dark logic behind what seems to be a coordinated push to break the intergenerational bonds between family members.

Younger people feel betrayed by their elders anyways. It’s a common feeling amongst Millenials and GenX that the Baby Boomers have screwed them with out of control housing prices, out of control education prices, and a job market that disappoints. They will do worse than their parents and grandparents. And they are angry about it.

I think screwing older folks - letting them potentially die in poverty (or worse) - will come much more easily than we would like to think.

Let’s hope I’m wrong.

I'm a Boomer. I feel like we were taught to not worry about the future, live for today, we'll be young forever. So many of us, and that includes me, didn't ever plan on getting to the point where we couldn't earn a living, where we would need to rely on the government (screw the Man was our motto). My husband and I will be working probably till we die. Part of me doesn't mind that, but part of me wishes we had been better prepared.

Makes a lot of sense to allow 15 million illegals enter the country over the last couple of years when we’re 30 trillion in the red. And then we’re going to screw everyone who has been paying into Medicare and social security in 15 years.