The Big, Beautiful and Deflationary Higher Education Bomb: The "Bennett Hypothesis" Wins.

Hiding in Trump / MAGA's "Big Beautiful Bill" are provisions on student loan financing that will likely have massive knock-on effects on higher education for decades.

As of yesterday, the “Big Beautiful Bill” - or, as it’s also known - reconcilitation bill HR.1 - is law. For congressional Democrats, progressives, and those on the left - the bill is a major defeat, as it significantly increases defense and border security funding (apparently increasing ICE funding alone by 10x!), enacts major tax reforms, and rolls back or rescinds a wide range of climate and green energy programs amongst other things.

It passed only narrowly - and with libertarian-leaning Republicans Thomas Massie and Rand Paul as defectors (they voted no), which isn’t surprising. It is difficult to argue that it’s a fiscally conservative bill per se.

That being said, with all of the hue and cry right now about the bill’s allegedly profligate spending (coming from the right side of the aisle), and against the provisions that would massively expand funding immigration enforcement / ICE from the left, what seems to be ignored are the provisions that affect higher education financing.

Before we look at these provisions - I want to mention a few things.

First, this guy. Meet Bill Bennett:

Mostly forgotten at this point, basically a relic of a Republican Party of many decades ago, and unknown to the Millennial and GenZ generation of today - let’s talk briefly about William J. Bennett.

Infamous in my generation as the “Drug Czar” under George W. Bush - the guy who vandalized my standup, coin-operated video arcade games with the motto “Winners Don’t Use Drugs,” Bill Bennett also served as the Secretary of Education under Reagan from 1985-1988, and in 1987, Bill Bennett authored the NY Times article, “Our Greedy Colleges” (you can read an archived version here).

In the article, Bennett argues that increases in federal student financial aid (particularly subsidies) enable colleges and universities to raise tuition, knowing that federal dollars will help students cover the higher costs.

He wrote:

"If anything, increases in financial aid in recent years have enabled colleges and universities blithely to raise their tuitions, confident that Federal loan subsidies would help cushion the increase… Federal student aid policies do not cause college price inflation, but there is little doubt that they help make it possible."

There’s been a lot of economics research on the “Bennett Hypothesis” in the last several decades.

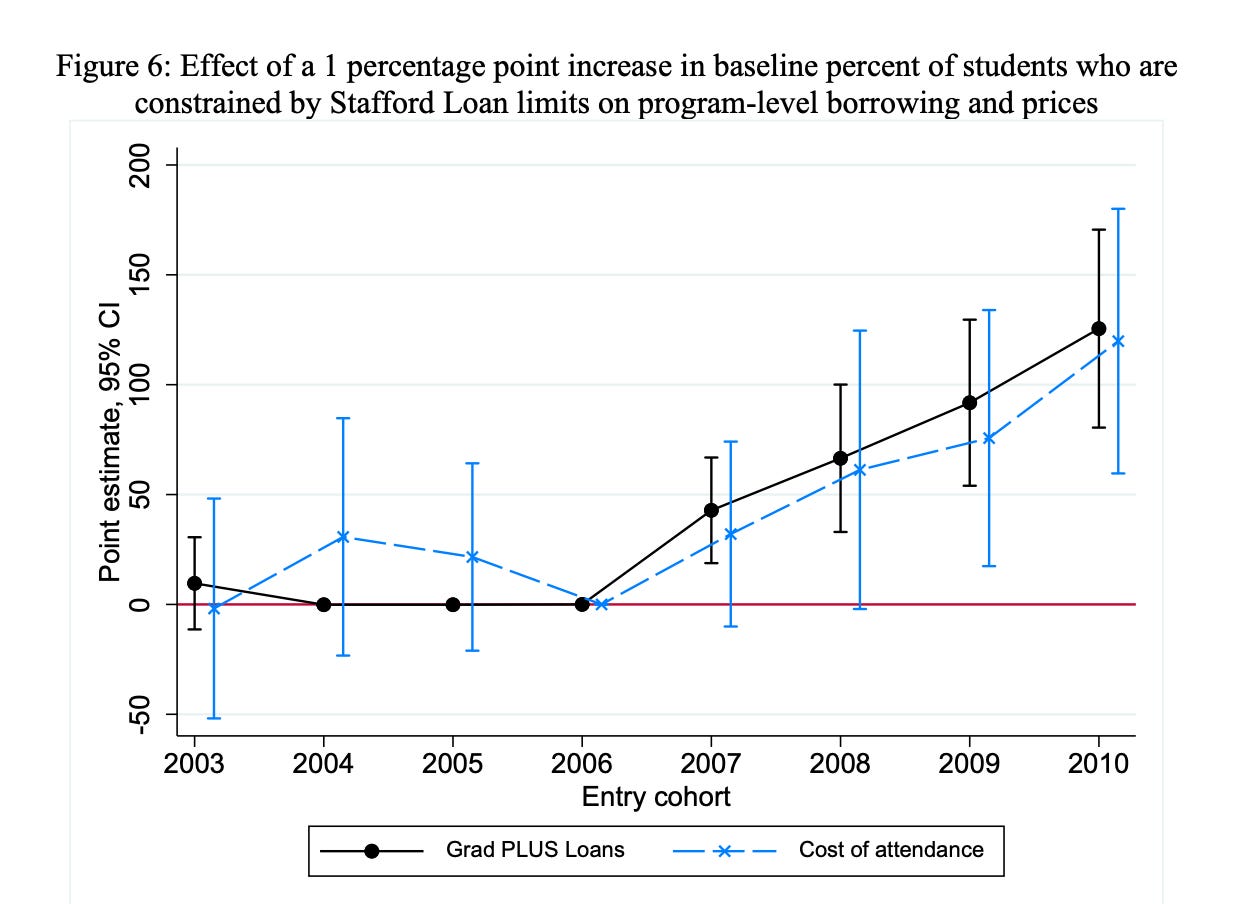

I’m no economist, but did a little bit of skimming around while pounding out this article, and found what appears to mixed, but generally positive support for the Bennett Hypothsis, including this one written in 2023, which features this chart:

(If you want to read a critique of this article - go here).

Although the process isn’t somehow direct, like colleges saying “loan limits and grant limits are up, must raise prices” - with a complex, and nuanced transmission mechanism, and while it shows up for certain programs better than others, generally speaking, the Bennett Hypothesis seems to hold. As loan programs with basically no underwriting standards became available with increasing limits (Stafford Loans, PLUS loans, etc.) - schools raised tuition, and costs skyrocketed.

So, what does HR.1 do to higher education loan and grant programs?

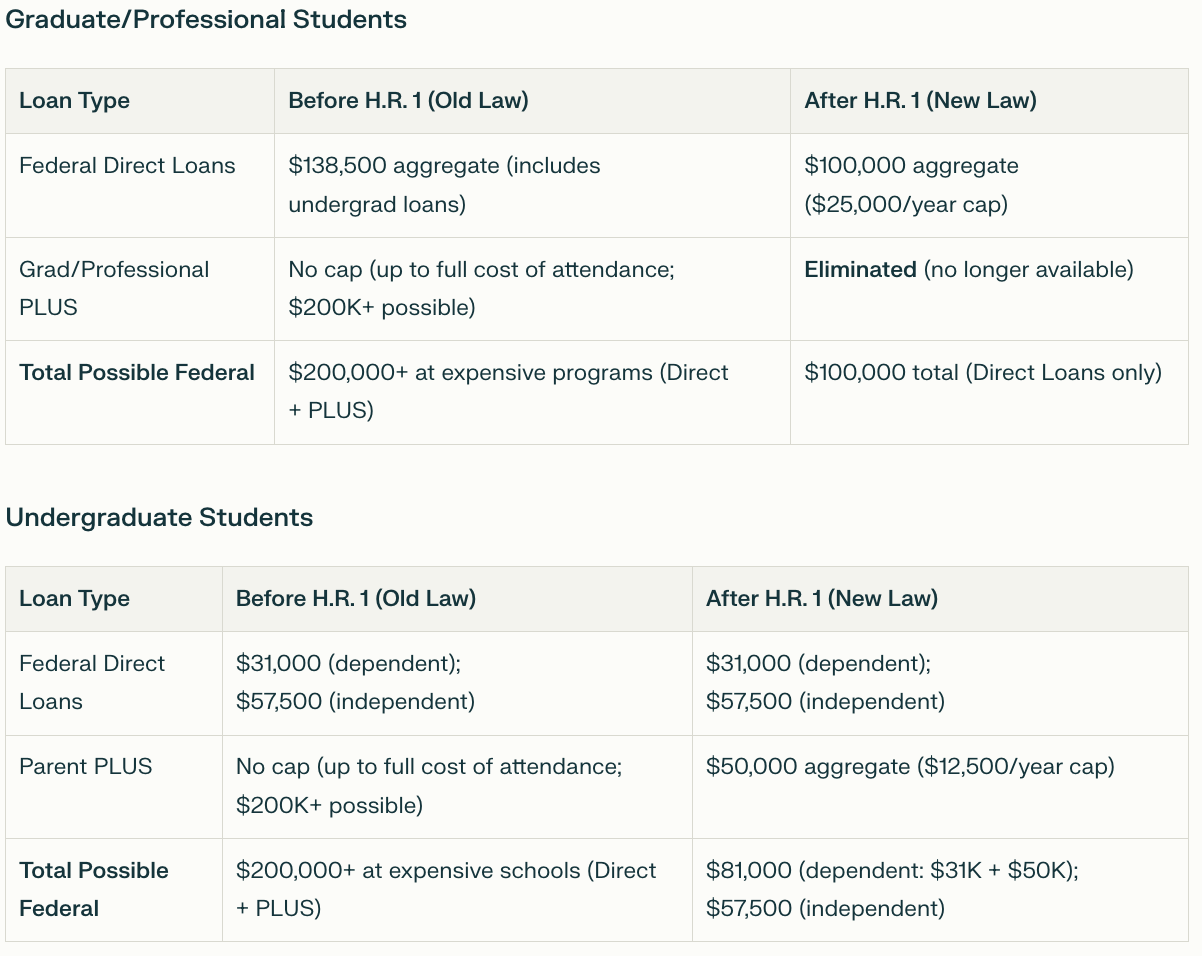

First and most significantly, the bill completely eliminates uncapped federal lending for graduate and professional school programs.

This alone is huge. Prior to HR.1 - students could borrow up to $138,500 via the federal Direct Loan program (e.g., Stafford loans), and then - by roping in their parents (through the PLUS loan program), they could add on essentially limitless federal borrowing, leading to debts well into six figures for students at professional PhD programs, law schools, and medical schools. The BBB, now law, abolishes the Graduate and Professional PLUS loan program completely, and limits total graduate federal borrowing to an aggregate $100K.

Focusing on PLUS loans for undergrads - while access to PLUS loans are not eliminated, they are now capped at $50K total - $12,500 per year maximum (previously unlimited - again, which often led to six figure debt loads for undergrads). Again, from effectively limitless amounts of debt that students were able to generate under the previous system, now undergrads are limited to an aggregate total of no more than $81K.

Although there’s a lot of other details in HR.1 that I am not covering, I got Perplexity.AI to summarize the big stuff, in two helpful charts below:

So What Does this Mean?

Again - I am no economist, and no policy expert.

But I know enough to know that incentives matter, and it looks like the “Bennett Hypothesis,” which was all about recognizing how the market responds to (distorted as they may be) incentives, has won the day, and made it’s way into probably what is the most significant set of changes to higher education funding in a generation or more.

It’s going to take a bit of time, and assuming the BBB’s provisions are durable (e.g., aren’t reversed by a new political regime in the White House / Congress) but I think realistically, this is what we might expect:

Mid-tier and lower-tier professional schools will go out of business. Think “University of Phoenix” type programs, many of which offer extremely expensive, low-quality & poorly-regarded law degrees and “online PhDs” in clinical or counseling psychology. These types of schools have functioned as giant heat sinks for student loan and grant monies for years, and are often leveraged to their eyeballs. The old saying “when the tide goes out, you can see who is swimming naked” is very operative here. I see a wave of mergers, restructurings, and bankruptcies in the near future.

Student behavior will begin to change over the medium term. One of the things I didn’t address in the BBB is a provision for a new program - a so-called “Workforce Pell Grant” program, which provides $4K per year of funding for basically vocational programs (think HVAC, welding, nursing programs, etc.) Between this and the choking off of unlimited funding for undergrad and grad programs, student behavior will *have* to change.

Tuition and fee inflation in higher ed, already moderating, could start heading sharply downward. Should be a really good ultimate and final test of the Bennett Hypothesis. What this means for GenZ and Gen Alpha students starting school in the coming years is that they could start seeing the mid and upper tier schools actually competing for them on price - an unheard of situation.

The proliferation of “activist” degrees with no practical value (think “gender studies,” “race studies” and “queer studies” majors and graduate degrees) will significantly decrease. Both market discipline as well as some provisions in HR.1 (“Subtitle E—Accountability, Section 84001: Ineligibility Based on Low Earning Outcomes”) that tie future graduate earnings to eligibility for financial aid should start seeing schools significantly back offerings for degrees with no obvious connection to real-world, practical value.

I do not think people are really understanding how significant this bill will be on the “business” of higher education. Major, major changes are underway. Hopefully, some very good ones.

*** EDIT (7/12/25): Found out recently the BBB apparently includes a significant exception to the new federal loan caps for graduate and professional students. Students pursuing MD (medical) and JD (law) degrees are permitted to borrow up to $200,000 in federal Direct Loans—double the cap for other graduate fields. This carve-out reflects the higher typical costs of medical and law education. It still represents a fairly significant limitation on grad borrowing.